Could ACDC Bring Needed Growth To Apple?

In June, Apple is expected to announce its progress on AI development, including Project ACDC, which stands for Apple Chips in Data Center. In a partnership with chip maker Taiwan Semiconductors, Apple hopes to make ACDC a competitor in what some are calling the AI arms race. Accordingly, ACDC will face tough competition from companies like Microsoft and Google, which are currently leading the AI charge. Project ACDC aims to create chips to run AI, unlike Nvidia apps that train AI. Consequently, Apple’s ACDC project should add to the demand for Nvidia’s chips.

Apple’s earnings release last week marked another disappointing earnings report. While the share price surged by nearly 7%, the results continue to indicate that Apple is a company with little growth. As we wrote in Apple’s Magic, its share buybacks are the primary source of EPS growth. The graph below shows its one and three annualized growth rates for sales and net income are lackluster. However, EPS has grown over the last three years as its share count has shrunk. While Apple can continue to financially engineer its stock higher, Project ACDC offers the company a new source of growth. Investors should pay close attention. ACDC could help Apple emerge from its growth doldrum.

What To Watch Today

Earnings

Economy

Market Trading Update

As discussed yesterday, the break above the 50-DMA likely confirms the recent correction is now over. Given the recent runup, the bit of intraday selling pressure was unsurprising, but it doesn’t change the technical backdrop. We recently noted that while the correction was expected, we repeatedly warned to take profits and rebalance holdings. The correction also provided opportunities. To wit:

“Continue to remain long equities and look for opportunities to add to positions opportunistically. When the MACD issues its next buy signal, it will coincide with an improvement in the overall market and provide a better entry point for investors.“

As shown, the MACD “buy signal” has been triggered, suggesting that, at least in the short term, the bullish bias has regained its hold. However, the markets are near-term overbought. Investors should use pullbacks to add exposure as needed.

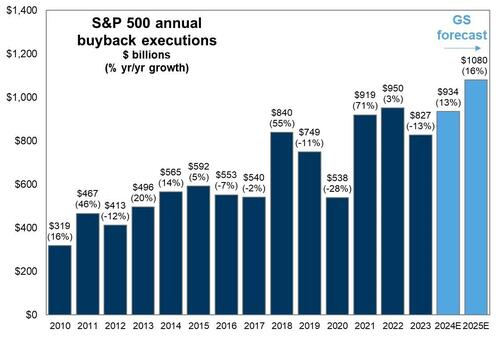

As Goldman Sachs noted yesterday, several key drivers for the market exist over the next couple of months. However, the most important is reopening the “buyback window” until June 14th, and the “rate cut hope cycle” is now back in full swing.

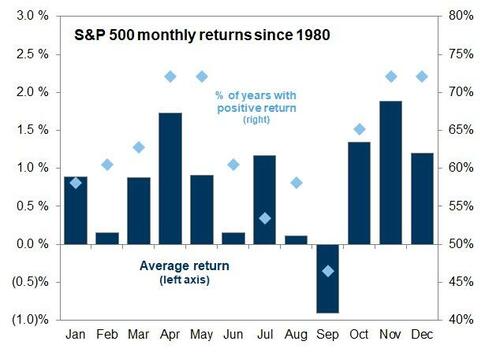

For now, continue to remain long equities, as the next few months tend to be historically biased towards the upside.

Sloos Points To Weak Business Outlook

The quarterly Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) released by the Fed on Monday continues to point to weak demand for commercial and industrial loans for small, medium, and large businesses, as well as consumer demand for loans. As shown below, the current level of demand from all-size companies has improved, but it is still aligned with levels seen during recessions. This aligns with the NFIB data, pointing to a downturn for small businesses. Consumer demand for loans is worsening after seeing significant demand from 2020 to 2022. With excess savings largely depleted, as we discussed HERE, the demand for consumers to borrow may start increasing if they are to keep pace with current levels of consumption.

Bank lending standards also tightened or remained unchanged for most business segments and consumers. Per the report:

While banks, on balance, reported having tightened lending standards further for most loan categories in the first quarter, lower net shares of banks reported tightening lending standards than in the fourth quarter of last year across most loan categories

Melting Cocoa

In our Commentary about a month ago, we wrote a short piece entitled: Add Cocoa To The List Of “Mooning” Assets. Per the article:

While everyone is following the prices of Bitcoin, Nvdia, and a handful of other assets whose prices are soaring, few appreciate the recent price action of cocoa. The graph below shows that the year-to-date performance of cocoa is nicely aligned with that of Bitcoin and Nvidia.

A lot has changed since we wrote that. As shown below, the price of Cocoa futures peaked about a week after we published that article. Since then, it has nearly given up 50%. The price is still double where it started the year. Similar price declines have occurred in some other commodities that were “mooning.”

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.